“Cryptocurrency Market Analysis: Navigating the Complex Web of Peer-to-Peer Trading, Risk Management, and Supply and Demand Dynamics”

The world of cryptocurrency has become increasingly popular in recent years, with prices skyrocketing and plummeting on a daily basis. However, behind the scenes lies a complex web of factors influencing the market’s direction. In this article, we’ll delve into the key aspects of crypto trading that can impact investors’ decisions.

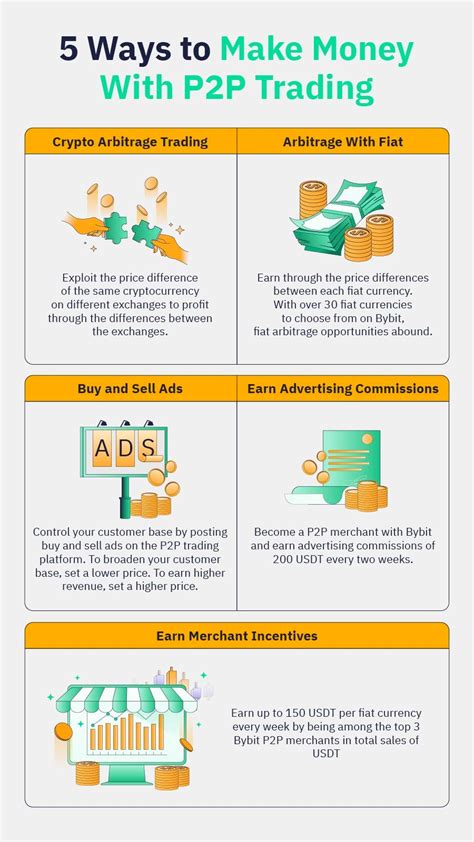

Peer-to-Peer Trading

Crypto traders use various platforms to buy, sell, and trade cryptocurrencies. Peer-to-peer (P2P) trading allows individuals to directly interact with each other, bypassing traditional exchanges. This model enables faster execution, lower fees, and increased transparency. However, P2P trading also introduces risks due to the decentralized nature of the market.

Risk Management

Risk management is a crucial aspect of crypto investing. To mitigate potential losses, investors employ a variety of strategies:

- Stop-loss orders: Traders set a limit on their losses to prevent further markdowns in case of unfavorable market movements.

- Position sizing: Investors allocate a specific amount of capital per trade to minimize potential losses.

- Hedging: Trading strategies like options and futures allow traders to hedge against market volatility.

Supply and Demand Dynamics

The supply-demand dynamics of the cryptocurrency market play a significant role in shaping prices:

- Fundamental analysis: Understanding fundamental aspects such as revenue, expenses, and growth prospects helps investors make informed decisions.

- Market sentiment: Investor attitudes, media coverage, and social media trends influence price movements.

- Adverse events: Disasters, economic downturns, or global events can lead to a sell-off in certain assets.

Key Indicators

Several indicators help traders gauge the health of the market:

- Trading volume: Increased trading activity often indicates increased demand for specific cryptocurrencies.

- Market capitalization: The total value of all outstanding coins can be an indicator of overall market sentiment.

- Price momentum: Short-term price movements can indicate buying or selling pressure.

Cryptocurrency Market Trends

Several trends are currently shaping the crypto market:

- Altcoin season: New cryptocurrencies, known as altcoins, often experience significant price fluctuations during this period.

- Regulatory uncertainty

: Changes in government policies and regulations can impact investor confidence and market sentiment.

- Competition from central banks

: Cryptocurrencies may face increased competition from traditional financial institutions in the coming years.

Conclusion

The world of cryptocurrency trading is inherently complex, with multiple factors influencing market direction. By understanding peer-to-peer trading risks, implementing effective risk management strategies, and staying informed about supply and demand dynamics, investors can make more informed decisions. As the crypto market continues to evolve, it’s essential for traders to stay vigilant, adapt to changing circumstances, and adjust their strategies accordingly.

Important Note

The cryptocurrency market is known for its high volatility and potential for significant losses. It is recommended that all traders approach this market with caution and thoroughly research any investment before making a decision.

Deixe um comentário