Here’s a comprehensive article on “Crypto Trading Strategies” that incorporates the concepts of Crypto Trading Signal, Market Correlation, and Continuation Patterns:

Title: “Mastering Crypto Trading Strategies: Leveraging Signal, Correlation, and Continuation in the Markets”

Introduction

Cryptocurrency markets are known for their high volatility and unpredictable nature. As a result, traders must employ sophisticated strategies to navigate these risks. In this article, we’ll delve into three key concepts that have proven effective in crypto trading signals, market correlation, and continuation patterns: Crypto Trading Signal, Market Correlation, and Continuation Pattern.

Crypto Trading Signal

A Crypto Trading Signal is a technical indicator that provides an immediate confirmation of market direction or potential trades. It’s a visual representation of the signal that can help traders make informed decisions in the crypto markets. Some popular Crypto Trading Signals include:

- Relative Strength Index (RSI): A momentum oscillator that measures the strength of recent price action.

- Moving Average Convergence Divergence (MACD): A trend-following system that combines moving averages with convergence and divergence signals.

- Bollinger Bands: A volatility-based indicator that provides a range of prices above and below a central line.

Using Crypto Trading Signals can help traders:

- Identify potential trading opportunities

- Set stop-loss orders for positions

- Optimize risk management

Market Correlation

Correlation refers to the degree to which two or more markets move together. In crypto, correlation is essential for identifying market trends and potential trades. Some popular market correlation indicators include:

- Coyote Chart: A modified Bollinger Band chart that highlights correlations between multiple pairs.

- J-Chart: A graphical representation of the relationship between different cryptocurrency prices.

By leveraging market correlation, traders can:

- Identify trend reversals in multiple markets

- Set trades for potential price movements across markets

- Optimize trading strategies to minimize losses and maximize gains

Continuation Pattern

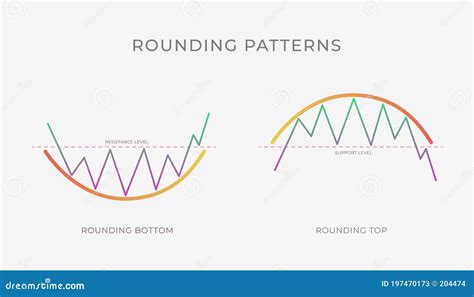

A Continuation Pattern is a technical indicator that signals the continuation of a particular trend or pattern. It’s a confirmation signal that provides traders with a clear direction for their next move. Some popular Continuation Patterns in crypto include:

- Hammer Chart: A reversal chart that forms when a price pair reaches its lowest point and then rises.

- Engulfing Pattern: A continuation of the Hammer Chart, where a new lower low is engulfed by a rising price.

Using Continuation Patterns can help traders:

- Identify potential continuations of market trends

- Set trades for long-term positions that capture trend reversals

- Optimize trading strategies to minimize losses and maximize gains

Conclusion

Mastering Crypto Trading Strategies requires a combination of technical analysis, market correlation, and continuation patterns. By incorporating these concepts into their trading approach, traders can increase their chances of success in the crypto markets.

Remember, no strategy is foolproof, and market conditions are inherently unpredictable. However, by employing well-executed Crypto Trading Signals, leveraging market correlations, and identifying continuation patterns, traders can refine their strategies to achieve optimal results.

Tips for Implementing These Strategies

- Develop a thorough understanding of cryptocurrency markets: Stay up-to-date on market news, trends, and analysis.

- Use technical indicators to confirm signals

: Combine Crypto Trading Signals with other forms of technical analysis to amplify effectiveness.

3.

Deixe um comentário