Title: Mastering Cryptocup trafficking with Shiba Inu (Shib): Wizard using a business indicator

Introduction

In recent years, the crypto currency has become increasingly popular, and token Shiba Inu (Shib) has attracted considerable attention to investors. As one of the largest tokens in market capitalization on the chain of intelligent binants, Shib is ready for explosive growth. However, movement in the complex world of cryptomic trafficking can be scary, especially for new investors. The aim of this article is to provide a comprehensive guide on how to use business indicators to invest SHIBA INA.

What are trading indicators?

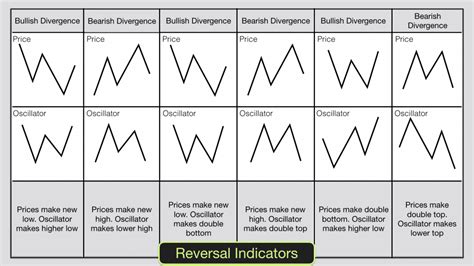

Business indicators are technical tools used by traders to analyze and predict prices in various financial markets. These indicators help to recognize trends, formulas and potential bends or continuing the direction of investment. There are many types of trading indicators, but some popular for crypto -trading include:

- Mobile mobile diameter : Calculate the average security price at a particular period to determine its trend.

- RSI (relative force index) : Measure the size of price changes and identify excessive or inverted conditions.

3

Using trading indicator for investment Shiba Inu

Now that you have a solid understanding of business indicators, let’s explore how to use them specially for investing in SHIB. Here are several key strategies:

- If the graph moves upwards, consider buying in support and sales level at the resistance level.

- Short -The Bears Grip

: Look for a short -term bear pattern where the upper Bollinger belt converges with the lower Bollinger belt. This indicates a potential turnover or prices clearing.

- Crossover RSI : Identify when RSI exceeds 70 and drops below 30, indicating that the crypto currency is exaggerated and caused by withdrawal.

Popular business indicators for Shib

Some popular business indicators that can be used to invest in SHIB include:

1.

- Oscillator of narrative stories : Momental indicator that shows the price compared to the extent to identify excessive or inverted conditions.

3

Bollinger belts : Volatility indicator showing two standard deviations above and below the moving diameter for the detection of trends, backward and puncture.

Tools to trade Shib

To effectively use trading indicators, you will need access to the following tools:

- Merchant Platforms : Use platforms such as Binance, Coinbase or Etoro for lever trafficking.

- Graph software

: Use a chart for a chart such as Metatrader, Ctrader or Thinkorswim to analyze and visualize data on the SHIB scale.

3

Crypto -trading applications : Explore applications such as Robinhood, Kraken or Twins to access business features.

Conclusion

Maintaining the art of commercial cryptomena requires a solid understanding of technical analysis and market trends. By including business indicators in your investment strategy for Shiba Inu (Shib), you can increase your chances of making profitable stores. Keep in mind that you always create losses, limit the size of the position, and watch cards regularly to adjust your strategy if necessary.

renunciation

This article is only for educational purposes and should not be considered investment advice. Cryptomes are very unstable and prices may vary quickly. It is important to do your own research, to set real expectations and never invest more than you can afford to lose.

Deixe um comentário