Battle of the Great Order: The Restriction of cryptocurrencies compared to market orders

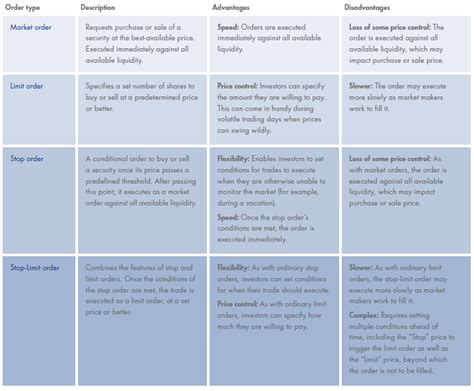

In the world of cryptocurrency stores, two basic concepts have occurred to help retailers to control the markets that are constantly changing:

border orders and

market orders . Although both types of orders can be effective when doing business, they differ significantly in their approach, so traders understand their advantages and disadvantages before deciding which one is most appropriate for them.

What are the border orders?

border order

is a type of order indicating a certain price to which trading should be done. This is an order where the crypto currency is not purchased or sold at a price below or above the stated limit. Basically, it’s like putting a “stop loss” to your stores.

If you renounce the border order, the market price will not immediately adjust to fulfill the condition stated in the order. Instead, it continues to fluctuate until the store is filled or rejected. This approach can help traders block profit at certain prices and avoid potential losses if the market moves against them.

What market orders are?

A market order , on the other hand, is a kind of order that indicates the current price of the CRIPTO currency for trade. It is the current execution of the trade at the prevailing market price. In simple words, it’s like putting a bet on the market “All or Non-Non”.

Market orders are usually used by traders who want to buy or sell crypto currencies quickly and effectively without worrying about potential effects on their profit. However, they are also associated with risks because their business can be done at any price, including those who may not fit the seller’s goals.

Benefits and Disadvantages of border orders

After we are covered, which limit orders and market orders, we dive into your advantages and disadvantages:

Limit orders: Professionals

- Risk Management : Limit orders help traders conclude profit at certain prices and reduce the risk of loss due to volatility in the market.

- Flexibility

: Merchants can adjust the stop price or set different prices for several stores with one order.

- Liquidity : The market orders are liquid as border orders because they allow customers and sellers to act freely without being related to certain prices.

Limit orders: Disadvantages

- slower version : It takes time to adjust the market to the said price, which can lead to a longer trading hour.

- Lower Payments : Since stores are being carried out at any price, traders can’t get so much profits if their store does not pass.

- Order Book : If there are several border orders at a particular price, the market can only be slowly adjusted, which can lead to long waiting.

Advantages and Disadvantages of Market Regulations

After examining the benefits and disadvantages of border orders, we should examine the benefits and disadvantages of market order:

market orders: professionals

- Speed : Market orders allow traders to immediately commit trade at any price.

- More payment : stores can be fulfilled faster, leading to more profit of some merchants.

- Liquidity : Market orders are generally liquidated order because they are carried out by all participants in the market.

market orders: Disadvantages

- Unique results : If the market is against the sellers’ expectations, your store cannot go by at all.

- Higher risk : Unforeseen price fluctuations can lead to losses for merchants that rely solely on market orders.

- Limited control : Due to the unpredictable nature of the market, the merchant has less control over the performance of business.

Diploma

Although borderline orders and market regulations offer valuable dealers’ instruments, they require different approaches and strategies.

Deixe um comentário