Large abyss: Cryptocurrency versus centralized funding (Defi) in the era of decentralized exchanges

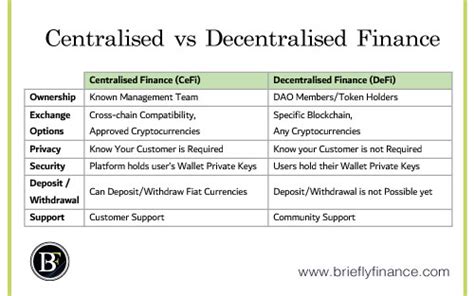

In recent years, the world of finance has undergone a significant shift. The increase in cryptomen, blockchain technology and decentralized exchanges (Dexs) changed the way we are considering money, trading and financial instruments. Two of the most important developments in this area are centralized funds (Defi) and exchange -based exchanges (CEX). While both offer exciting opportunities for investors and traders, they differ significantly with their basic principles, advantages and disadvantages.

centralized finance (defi)

Defi, also known as decentralized finances, is a financial technology that works completely outside traditional centralized systems. Defi platforms use blockchain technology to provide access to financial services such as loans, loans, trading and investment. The best known examples of Def are:

- UNISWAP (Ethereum): Decentralized Stock Exchange for Cryptocups.

- MAKERDAO (EOS): Decentralized platform of loans that allows users to borrow and borrow tokens.

- Compound (BTC/ETH): Decentralized platform of interest rate management.

The key characteristics of Defi are:

* Decentralized Administration of Public Things : Decision -making is divided between participants, reducing the risk of centralization.

* Equity contracts : Intelligent blockchain contracts provide agreements without intermediaries.

* Interoperability during the chain : Ability to transmit assets through various blockchains.

* low fees and liquidity : lower transaction costs and increased trading volumes.

Pluses:

1.

2.

3

Improved user experience : Decentralized technology allows greater flexibility to be a user interface, usability and customization.

Disadvantages:

1.

- Intelligence vulnerability of smart contracts : If smart contracts are not implemented correctly or have vulnerable places, it can lead to significant user losses.

3.

centralized finance (cex)

Traditional centralized finance (CEX) operates through a network of banks, investment companies and other financial institutions, which act as intermediaries between investors and financial markets. CEX provides access to financial services such as trading, loans and investing, but with centralized control.

The key characteristics of the CEX are:

* centralized infrastructure : Bank systems, financial institutions and investment companies provide liquidity and link to assets.

* Regulatory Supervision : Governments regulate and promote compliance with laws and regulations.

* Institutional Knowledge

: Experts have extensive expertise in the field of risk management and accepting informed decisions.

Pluses:

1

- Liquidity management

: centralized infrastructure can manage large volumes of market data, leading to higher liquidity.

- Compliance with regulation regulations : Compliance with existing laws and regulations is generally easier in a centralized environment.

Disadvantages:

1.

2.

Deixe um comentário