Trading Fees: The Silent Killer of Cryptocurrency Profits

When it comes to trading cryptocurrencies, one of the most significant expenses that can eat your profits is trading fees. These fees are typically deducted from each trade and can range in percentage from 0.5% to over 10%, depending on the exchange you’re using.

In this article, we’ll delve into the world of trading fees and explore how they impact your cryptocurrency profits.

What are trading fees?

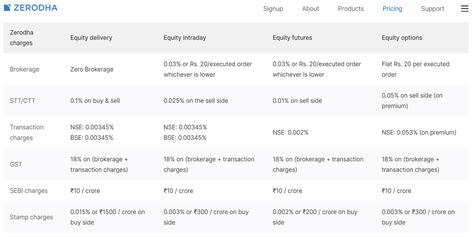

Trading fees refer to the charges imposed by exchanges for processing trades. These fees can include various elements such as:

* Exchange Commission : A flat fee charged by each exchange for every trade.

* withdrawal fees : fees levied when you want to withdraw your cryptocurrencies from an exchange.

* Liquidity fees : fees charged for buying or selling large volumes of a particular cryptocurrency.

How Trading Fees Impact Your Profits

Trading fees can significantly reduce the profitability of trading cryptocurrencies, especially if you are using low-fee exchanges. Here are some reasons why:

- Reduced profitability : High trading fees can lead to lower profits due to increased costs.

- decreased liquidity : exchanges that charge high fees may have less liquidity, making it harder for buyers and sellers to find each other.

- Increased risk : Trading fes can create a false sense of security, leading you to overtrade or hold andto positions longer than you should.

Types of Cryptocurrency Trading Fees

There are severe types of trading fees that exchanges charge:

- tiered pricing

: Exchanges offer tiered pricing for different amounts of trades, with higher fees charged for larger volumes.

- tier-based commission : some exchanges use tier-based commission structures, where the cost increases as you make more trades.

- Variable fees : Exchanges may charge variable fees based on market conditions or other factors.

Best Practices to Minimize Trading Fees

To minimize trading fees and maximize your profits, follow these best practices:

- Choose a low-fee exchange : Research and select an exchange that offers low-fee options for your preferred cryptocurrency.

- Use Liquidity-Rich Exchanges : Exchanges with High Liquidity Can Help You Find Better Prices and Reduce the Need to Overtrade.

- Consider Alternative Trading Options : Platforms like Binance, Huobi, or Kraken Offer Competitive Fees and a Wide Range of Cryptocurrencies.

- Optimize your trades : use technical indicators and risk management strategies to minimize your losses and maximize profits.

Conclusion

Trading fees are a significant expense that can eat your cryptocurrency profits. By understanding the different types of trading fees and best practices for minimizing them, you can make informed decisions about your trading strategy and optimize your profits. Remember, low-fee exchanges and liquidity-rich options can help you achieve higher success rates in the world of cryptocurrency trading.

Disclaimer

: Trading Cryptocurrencies Carries Significant Risks, including Market Volatility and Regulatory Changes. Cryptocurrency traders should always do their own research and consider their own risk tolerance before investing.

Deixe um comentário