The role of market makers in enhancing liquidity in cryptocurrency markets

Cryptocurrency, Bitcoin has set a new standard for decentralized digital currencies. However, like any other financial market, it is not immune to challenges such as liquidity. In this article,

What are Market Makers?

Market makers (MMS) are firms or individuals that engage in a two-way market where they buy and sell an asset at a specified price. In Trading activities.

Key Benefits of Market Makers

Market Makers have several benefits that enhance liquidity in cryptocurrency markets:

- Liquidity Provision

: Market makers providity by offering buyers and sellers the opportunity to trade cryptocurrencies at prevailing prices. This helps to create a more stable price environment, which is essential for traders and investors.

- Price Discovery : by facilitating trades, market makers help to establish fair prices for cryptocurrencies. The coins at these new prices.

. They can absorb losses fluctuate negatively, ensuring that traders are not left with significant losses.

- Competitive Pricing : By Tooling Competitive Prices, Market Makers Encourage Trading Activity Among Participants. This Foster Competition between Mmas, Driving Prices Closer Together and Increasing Overall Liquidity.

Types of Market Making

There are two Primary Types of Market Making:

- Arbitrage-Based Mms : Arbitrageurs Buy Low and Sell High in one market to profit from Price disparities.

2.

Cryptocurrency Market Makers

Several prominent cryptocurrency markets have emerged, providing liquidity and facilitating trading activities:

1.

2.

.

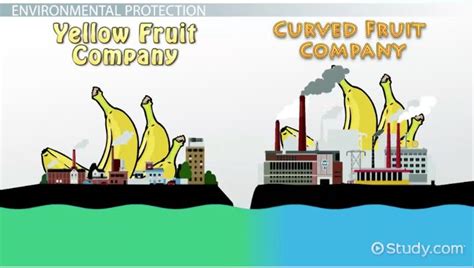

Challenges and Opportunities

Cryptocurrency markets, there are also challenges that need to be addressed:

1.

.

.

Conclusion

The role of market makers is crucial in enhancing liquidity in cryptocurrency markets.

Deixe um comentário