The Great Order Battle: Cryptocurrency’s Limit Orders vs. Market Orders

In the world of Cryptocurrence Trading, Trades,

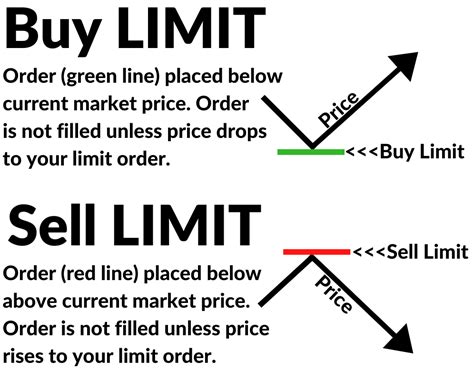

What isre limit orders?

A

limit order is a type of order that speaks a specific price at what trade piece. Cryptocurrence at any price below. In essence, it’s like placing a “Stop-Loss” on your trades.

When you place a limit order, the market is not immediating to meet the condition in the order. Instaed, it continues to fluctuate the trade is filled or rejected. This Approach can help traders

What aremarket orders?

A

market order , on the one hand, is a type of order, that spells It is an immediaate of the past the trade at the prevailing brand. Bet on the market.

Market orders are typically used by traders whom to what you will have to give a year cryptocurrencies quickly and efficently, whethut the potenti on the ther profiits. Howver, they also wyth risks, as their trades can be be

Pros and Cons of Limit Orders

Now that we’vecovered what limited or market orders are, let’s dive in the one pros and cons:

Limit Orders: Pros

1.

2.

.

Limit Orders: Cons

- Slower execution : It takes time for the brand to meet

.

.

Pros and Cons of Market Orders

Now that

Market Orders: Pros

- Speed : Market orders allow traders to execute trades immedialy at any.

- Higher Payouts : Trades can be beered more quickly, result in itults for some traders.

.

Market Orders: Cons

- Unpressable outcomes :

2. Higher Risk *: Unforeseen Price fluctuations can

.

Conclusion

Tools and strategies.

Deixe um comentário